39

Volume 3 Issue 6

|

CDSPI isanot-for-profitorganizationwhosemission isto provideafullrangeoffinancialsolutionsthatmeettheuniqueneeds oftheCanadiandentalcommunitythroughouttheir lives.Ourmembers includetheCDAandparticipatingprovincialandterritorialdentalassociations.Reports will not show the compensation paid to

individual advisors, but rather to the investment

companies they work for, and they must also provide

a brief explanation of what trailer commissions are.

For mutual funds, it’s worth noting that CRM2

disclosure regulations only deal with the portion of

your MER that is paid to your investment firm. To find

out about the fund management fees associated with

the funds you own, you would still need to check the

product disclosures for those funds.

•

The annual report on performance.

This is designed

to give investors a better understanding of their

personal rate of return after costs have been

deducted. It provides results for your full account,

which may include individual equities, bonds,

mutual funds, or cash. The report must show, in

percentages and actual dollars, the market value at

the beginning of the year, deposits, withdrawals,

dividends, any change in market value, and the

closing balance at the end of the year. It will also show

your compounded, annualized rate of return from

the time you originally opened the account with the

institution, as well as your returns for the past 3, 5, and

10 years if that information is available.

The purpose of this article is to provide a brief overview of

the new reporting requirements. For further explanation

of all the particulars of phase three of CRM2, we suggest

that you speak to your financial advisor or investment

firm.

a

Advisory services are provided by licensed advisors at CDSPI Advisory Services Inc. Information

in this article is for informational purposes only and is not intended to provide financial, legal,

accounting or tax advice. Restrictions to advisory services may apply in certain jurisdictions.

If You Hold CDSPI Funds

Since CDSPI Funds are segregated funds, which are regulated

by the insurance industry, CRM2 requirements do not apply to

them. That being said, your Investment Planning Advisor can

provide similar information to that required by CRM2 at your

request.

It’s important to point out that CDSPI funds do not charge

trailer fees, and there are no front-end or back-end “loads”

(commissions) when buying or selling a fund.

Since advisors

from CDSPI Advisory Services Inc. do not work on

commission, they can be objective about the investments

they recommend.

Their financial planning advice is offered as

a member benefit of the CDA and participating provincial and

territorial dental associations.

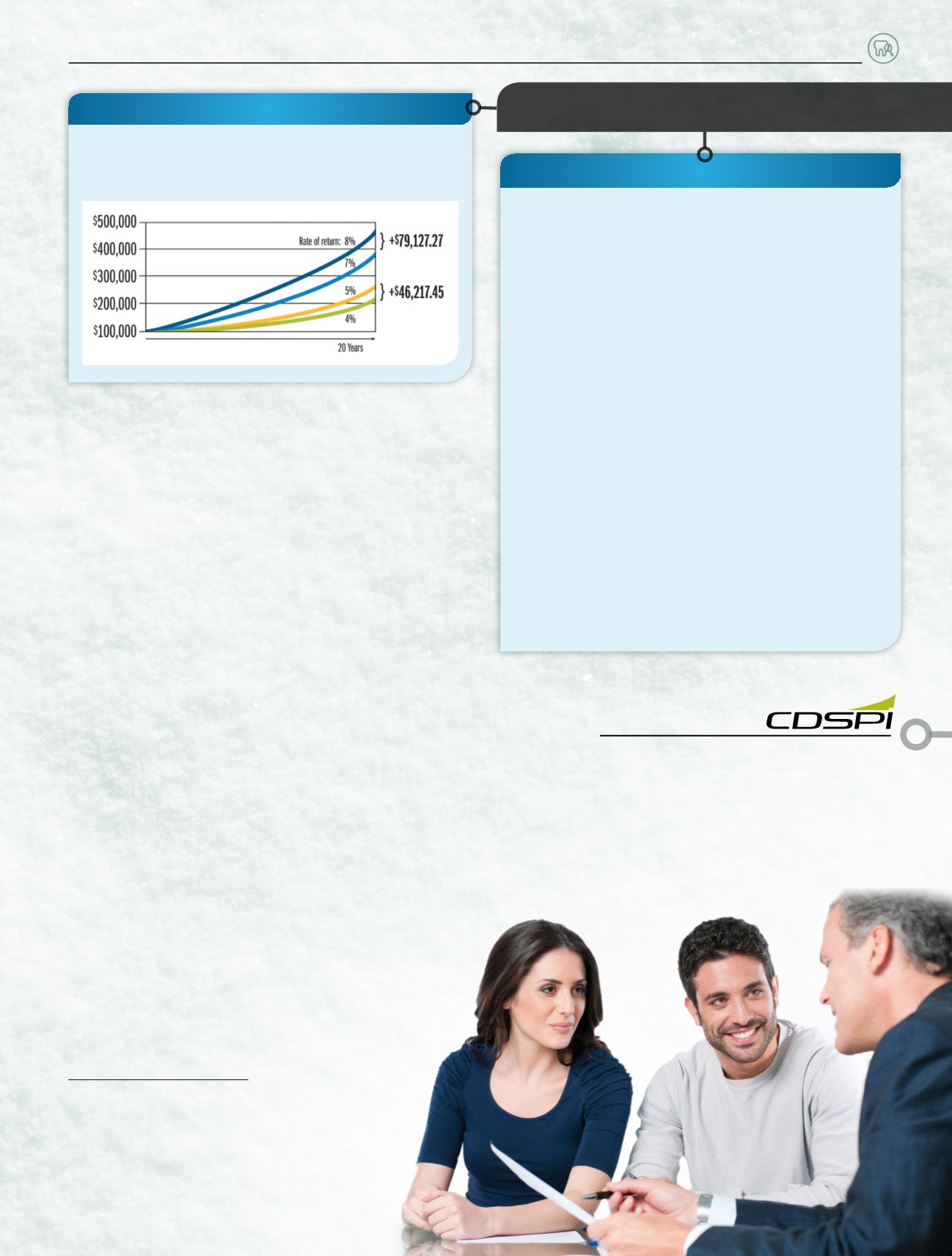

A benefit of our structure is that we are able to leverage the

buying power of the dental community to negotiate lower

fees, which helps lower the MERs for our funds. While MERs

for funds in Canada can reach as high as 3% or more, the

average MER for CDSPI funds is 1.26%.

2

As you can see from

the accompanying chart, it’s important to consider fees in any

investment decision.

If you would like to learn more about the advantages of

investing with CDSPI Funds, I invite you to contact us at

1-800-561-9401

or send an email to

investment@cdspi.com .Do Fees Make a Difference?

You be the judge. This chart shows two examples of the

incremental returns you would achieve with a 1% fee advantage

on an investment of $100,000 over 20 years.

1.Source:

BusinessNewsNetwork

,2015

2.Management feesaresubjecttoapplicabletaxes.

S

upporting

Y

our

P

ractice